Financial management is the heartbeat of a successful small business. But not all entrepreneurs are on the same level when it comes to managing their money. Just like your business evolves in how it operates and strategizes, your money management skills also progress through different phases. Knowing these phases can help you figure out where your business is and what moves you need to make to level up.

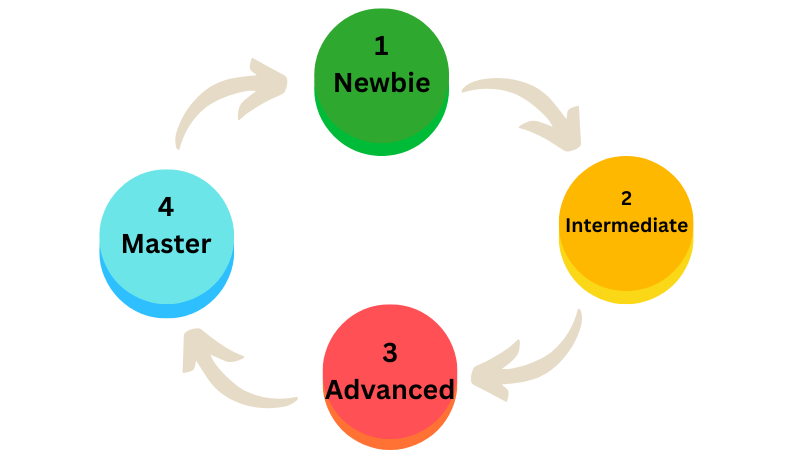

Here’s a breakdown of the four stages of small business financial management:

Stage 1: Newbies

Defining Characteristics:

- Basic bookkeeping practices.

- Handling finances solo, often without formal training.

- Relying on paper records or basic spreadsheets.

Newbies are usually in survival mode. The focus is on tracking income and expenses, often to meet tax obligations or keep an eye on cash flow. The systems in place are minimal, and financial decisions tend to be more reactive than strategic.

Key Challenges:

- Not enough time for financial tasks.

- Trouble spotting areas for financial improvement.

- Limited understanding of the business’s financial health.

How to Move Forward:

Invest in learning basic financial management principles and consider using accounting software like QuickBooks, Xero, or Freshbooks to streamline tracking. Set aside dedicated time each week to review your finances, even if it’s just for 30 minutes.

Stage 2: Intermediate

Defining Characteristics:

- Using accounting software to track finances.

- Better organization of financial data.

- Some understanding of profitability and cash flow, but strategic insights are still lacking.

At this stage, business owners typically have better systems in place, such as invoicing, expense tracking, and perhaps payroll management. While tools and automation reduce manual tasks, they don’t replace the need for financial expertise. Business owners may still find it difficult to interpret financial reports or make data-driven decisions.

Key Challenges:

- Missing the bigger picture of financial performance.

- Overlooking key metrics like profit margins, revenue growth, and cash flow trends.

- Operating reactively rather than proactively.

How to Move Forward:

Start analyzing reports like profit and loss statements or cash flow summaries. Take time to learn what these numbers mean for your business’s overall health. You may also consider consulting with a bookkeeper or accountant for guidance.

Stage 3: Advanced

Defining Characteristics:

- Regularly reviewing financial reports.

- Implementing a basic cash flow management plan.

- Starting to forecast and plan for the future.

Advanced businesses begin to shift from reactive financial management to proactive planning. Owners at this stage understand the importance of reviewing financial data and start using it to guide their decisions. Whether it’s planning for seasonal fluctuations or setting revenue goals, the business is beginning to run with greater financial confidence.

Key Challenges:

- Gaps in expertise when interpreting complex financial data.

- Limited ability to create long-term financial strategies.

- Difficulty scaling systems as the business grows.

How to Move Forward:

Refine your financial processes by incorporating regular meetings to discuss financial performance. Start exploring more advanced forecasting tools or hiring part-time financial consultants to assist with growth strategies.

Stage 4: Master

Defining Characteristics:

- Partnering with a Fractional CFO or financial expert.

- Building a proactive financial strategy aligned with business goals.

- Using data-driven insights to maximize profit and fuel growth.

At this stage, business owners take full advantage of financial expertise to optimize their business operations. A Fractional CFO can help you go beyond the numbers, creating strategies that increase profitability, improve cash flow, and position your business for sustainable growth.

Key Challenges:

- Ensuring that financial strategies align with long-term business objectives.

- Staying agile as the business and market conditions evolve.

How to Stay on Top:

Continue leveraging the expertise of a financial professional to monitor and refine your financial strategy. This includes regular financial reviews, strategic forecasting, and staying ahead of industry trends.

What Stage Are You In?

Every small business begins at the beginner stage, but the goal is to keep moving forward. Each stage brings new tools, insights, and strategies to help you grow your business and achieve financial stability.

If your business is ready to graduate to the Master stage, consider partnering with a Fractional CFO. This professional support can provide the strategic insights and planning your business needs to thrive.

Are you ready to take the next step? Let’s connect to discuss how financial strategy can unlock your business’s full potential.